Understanding Your Credit Score: Key Factors and Long-Term Impact

- Sam Cao

- Sep 4, 2025

- 5 min read

Imagine you’re about to sign a lease on your dream apartment, only to have the landlord hesitate when they see a three-digit number on your application. That little sequence—your credit score—can open doors to the best interest rates or slam them shut, forcing you into a high-cost world of fees and higher payments. But what exactly is a credit score, and why does it wield so much power over your financial give life?

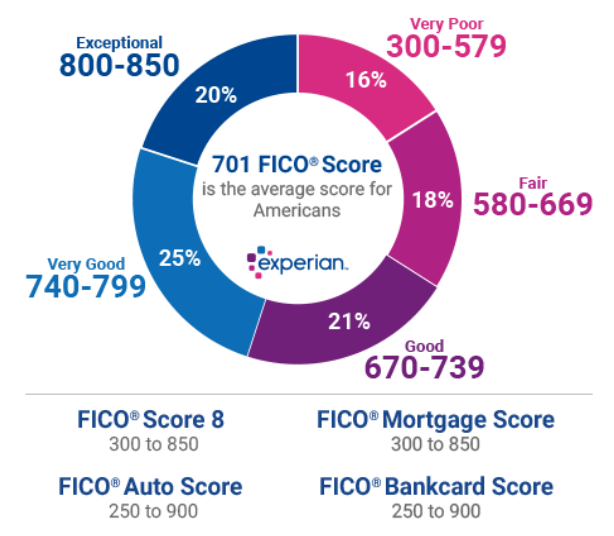

Your credit score indicates how much you've acted responsibly with past loans. It is calculated by analyzing your credit reports, which include whether you pay your bills on time, the amount of your available credit, and whether you have recently applied for new credit. The average score for this test falls between 300 (very poor) and 850 (extremely consistent), with most people scoring between 600 and 704.

Most lenders use the FICO®Score, which was developed by the Fair Isaac Corporation and is considered the industry's gold standard for credit risk assessment. VantageScore, a well-known model, was developed by the three major credit bureaus—Equifax, Experian, and TransUnion—to offer standardized scoring across all three agencies. The credit data used in each model is the same, despite variations in their weightings for different factors.

The four key factors that determine your score are as follows, with accompanied percentages describing how much they impact your score:

Late or missed payments have the greatest negative impact on your score, with payment history accounting for 35%.

When you're using your entire credit limit, it's often a red flag if you have accumulated debts that are below 30%.

The length of your credit record (20%) is important to lenders because it gives them assurance about the borrowing process.

The prospect of opening multiple accounts in a short period can give the impression of financial hardship when it comes to new credit (15%).

Why does this matter? Lower interest rates on mortgages, auto loans, and credit cards are frequently linked to higher scores. Saving even one percentage point on a mortgage can mean thousands of dollars in interest over the life of a 30-year loan, as can be seen in the example graph below, calculated using a fixed-rate mortgage formula. This graph shows how just a 1% increase in mortgage interest—from 3% to 4%—adds over $60,000 in total interest over 30 years on a $300,000 loan. At 5%, that extra cost jumps to $124,000.

Landlords, utility companies, and some employers also check credit scores as a means of assessing risk and measuring responsibility. Having an inadequate score may require you to pay higher security deposits than a high-score applicant.

Fortunately, you have rights and tools at your fingertips. Every 12 months, AnnualCreditReport.com provides free copies of your credit reports to you by the three major bureaus, without any impact on your scores under federal law. Free “soft pull” services that show your FICO® Score or VantageScore without damaging your credit are also available from many banks or apps.

If your report contains errors—which surprisingly affect an estimated 25% of consumers—you can file disputes to have inaccuracies corrected or removed. New policy changes by the Consumer Financial Protection Bureau have prevented outstanding medical bills from negatively impacting your credit, potentially enhancing the credit score of millions who have experienced costly health crises.

Here are some tips for building or rebuilding your score boils down to consistent, responsible habits:

Pay on time, every time. With a 30-day delay in payment, your score is reduced by 100 points.

Diversify responsibly. Adding credit to your mix can be achieved by taking out a small personal loan and using it wisely.

Use a secured credit card. If you're new to credit or rebuilding, a secured credit card can be a great tool. You deposit money into an account, and your credit limit is typically equal to that deposit. Use it responsibly, and it can help build your credit history.

Pay in full every time, not just the minimum. When you only make the minimum payment, you’re paying a lot in interest over time, which can make it harder to reduce your debt. Paying in full avoids interest charges and keeps your credit utilization low.

Utilize rewards programs. If you have a rewards credit card, use it for purchases that fit your budget. Just be sure to pay off the balance in full each month to avoid interest. Using rewards wisely can help you save money or earn travel points while improving your credit.

Avoid opening too many new accounts. While it might be tempting to sign up for new credit cards to earn rewards or get discounts, opening multiple accounts in a short period can hurt your credit score. Each application triggers a hard inquiry, which can reduce your score temporarily.

Keep old accounts open. The longer your credit history, the better. Avoid closing old, unused accounts, as they contribute to the length of your credit history, which can positively impact your score.

Treat your score as the economic counterpart to a driving record – it represents what you've done, but determines which routes you’re allowed to take and how fast you are allowed to go. So whether you’re buying a car, renting an apartment, or just signing up for a utility plan, a strong score can save you real money and real stress. Ignoring it can lead you into tighter budgets and elevated expenses. Decoding credit scores isn’t just for bankers; it's for anyone who wants to hold on to more of their hard-earned money and steer clear of financial upsets. Next time you see that three-digit number, remember it’s more than just a hurdle—it’s a tool you can sharpen to build the life you envision.

Works Cited

Consumer Financial Protection Bureau. “What Is a Credit Score?” ConsumerFinance.gov, 24 Jan. 2024, https://www.consumerfinance.gov/ask-cfpb/what-is-a-credit-score-en-315/. Accessed 9 July 2025.

Consumer Financial Protection Bureau. “Understand Your Credit Score.” ConsumerFinance.gov, June 2025, https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/understand-your-credit-score/. Accessed 10 July 2025.

Consumer Financial Protection Bureau. “Credit Reports and Scores.” ConsumerFinance.gov, 2024, https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/. Accessed 9 July 2025.

Consumer Financial Protection Bureau. “How Do I Get and Keep a Good Credit Score?” ConsumerFinance.gov, Mar. 2025, https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-and-keep-a-good-credit-score-en-318/. Accessed 10 July 2025.

FICO. “FICO® Score.” FICO.com, https://www.fico.com/en/products/fico-score. Accessed 9 July 2025.

MarketWatch. “Errors on Credit Reports Are an ‘Epidemic’ – But Nearly 25% of Americans Can’t Access Their Credit Reports to Check for Mistakes, Consumer Advocates Say.” MarketWatch, 2024, https://www.marketwatch.com/story/errors-on-credit-reports-are-an-epidemic-but-nearly-25-of-americans-cant-access-their-credit-reports-to-check-for-mistakes-consumer-advocates-say-3ad83448. Accessed 10 July 2025.

The Associated Press. “How Removing Unpaid Medical Bills From Credit Reports Could Help Consumers.” APNews.com, Jan. 2025, https://apnews.com/article/8a81e776bf4cb3aa3c1bc7187f5af96a. Accessed 9 July 2025.

“What Are the Different Credit Scoring Ranges?” Senate Cents: A Financial Wellness Blog, https://www.ussfcu.org/media-center/senate-cents-a-financial-wellness-blog/blog-detail.html?cId=15520&title=what-are-the-different-credit-scoring-ranges. Accessed 12 Jul. 2025.

Comments