A Study of High-Tax Welfare States

- Andrew Huynh

- Jan 23

- 4 min read

The success of the welfare state system in Northern Europe—integrating economic vitality, social security, and political confidence—is the result of a combination of factors that most larger countries find difficult to replicate. The secret isn’t one particular policy, but an interlocking social investment ecosystem, where government, business, and labor each make commitments that reinforce each other’s credibility. High taxes fund visible, high-quality services; universal, stigma-free entitlements ensure broad support; and active labor market programs keep almost everyone employed, which helps keep public finances sustainable.

Employment is a good place to start. The OECD Employment Outlook 2023 ranks Denmark, Norway, Iceland, Sweden, and Finland among the leaders in labor-force participation. The Nordic model relies on turning citizens into taxpayers as early as possible and keeping them in the workforce for as long as possible. Generous parental leave, subsidized childcare, and retraining vouchers ensure that parents, older workers, and the recently laid-off rarely exit the labor market for long. Since benefits are funded by broad-based income and consumption taxes, each additional worker strengthens rather than burdens the system.

Equally important is that the model treats social spending as an economic asset, not a cost. Early investments in childcare and schooling raise productivity at the entry level, while lifelong education policies help workers update their skills well into middle age. The result is a labor force more resilient to economic shocks and technological change than one where individuals must fund their own reskilling.

This resilience was visible during the pandemic. An OECD report comparing crisis responses found that quick rollout of wage-subsidy programs and digital job-matching services helped all five Nordic countries avoid large spikes in long-term unemployment and recover more quickly than average. Because workers could count on generous income replacement during furloughs, consumer demand held steady. And because benefits were both temporary and active, most people returned to work quickly.

Naturally, this isn’t cheap. In 2022, Denmark and Sweden collected more than 41 percent of GDP in taxes—about 14 points higher than the U.S.—yet still ranked among the world’s most competitive economies. Crucially, the tax burden is structured to feel fair: payroll contributions are capped, everyone pays consumption taxes, and business taxes are moderate, encouraging firms to stay and invest.

Trust is what holds this fairness together. According to Transparency International’s 2024 Corruption Perceptions Index, Denmark and Finland ranked first and second globally, with Norway and Sweden close behind. Citizens who believe their taxes are spent honestly are more willing to pay them. Clean, efficient public procurement also ensures that services are delivered on time and within budget, reinforcing trust in the system.

Collective bargaining ties the system together. National unions and employer federations negotiate wage norms that reduce income disparities while allowing companies flexibility in adjusting working hours. Because wages at the lower end are relatively high, the state invests heavily in vocational training to ensure productivity keeps pace with pay. And because layoffs are relatively easy, unemployment insurance and retraining support are correspondingly strong. The Danish “flexicurity” model—easy firing, strong income support, and active job placement—has become a template for the region.

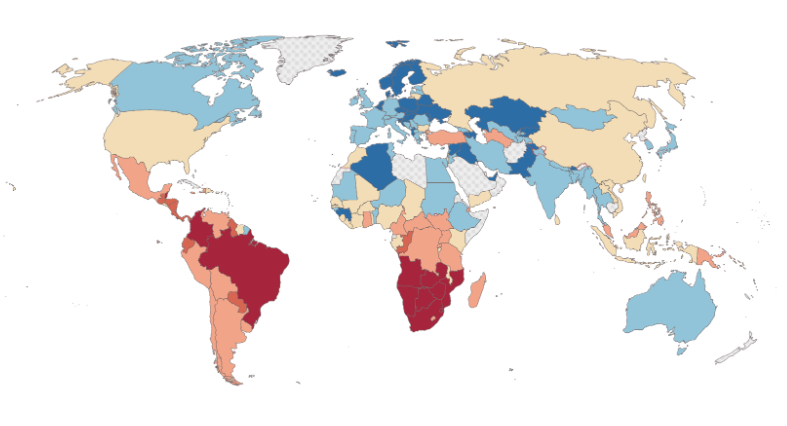

The outcomes are clear. Nordic countries consistently combine low-to-mid 0.27 Gini coefficients with GDP per capita above the OECD average. They regularly top international happiness rankings, and their female employment rates—around 75 percent—not only reduce child poverty but also widen the tax base. During recessions, universal benefits serve as automatic stabilizers, supporting demand without the need for emergency legislation and allowing governments to focus on long-term reform.

None of this means the model is without friction. Aging populations and high levels of migration create pressure on both budgets and social cohesion. Yet the same features that make the system costly—transparent rules, active labor-market policies, and a culture of social dialogue—also make it adaptable. Whether the issue is integrating refugees, funding green transitions, or regulating AI, the Nordic approach is to bring all stakeholders to the table, review the evidence, and adjust policies before problems escalate.

In short, Northern European welfare states succeed not because they shield themselves from markets, but because they insure citizens against the risks markets create—and can afford to do so because nearly everyone contributes. High trust, clean government, and sustained social investment turn what might look like a fiscal burden into a virtuous cycle of productivity, equality, and resilience.

Works Cited

Dahlström, Sebastian. “The Nordic Welfare Model: Strong Public Foundations for a Productive Private Sector.” Nordic Welfare Center, 7 Sept. 2023, https://nordicwelfare.org/en/nyheter/the-nordic-welfare-model-strong-public-foundations-for-a-productive-private-sector/.

“Denmark and Finland on Top of List of Least Corrupt Countries.” United Nations Regional Information Centre for Western Europe, 11 Feb. 2025, https://unric.org/en/denmark-and-finland-on-top-of-list-of-least-corrupt-countries/.

“Economy of Denmark.” Wikipedia, 6 Jul. 2025. Wikipedia, https://en.wikipedia.org/w/index.php?title=Economy_of_Denmark&oldid=1299137339.

“Infographic: The World’s Most Competitive Economies.” Statista Daily Data, 18 Jun. 2024, https://www.statista.com/chart/30233/global-competitiveness-world-map.

Kenton, Will. “Nordic Model: Comparing the Economic System to the U.S.” Investopedia, 20 Aug. 2024, https://www.investopedia.com/terms/n/nordic-model.asp.

“Nordic Lessons for an Inclusive Recovery? Responses to the Impact of COVID-19 on the Labour Market.” OECD, 16 Mar. 2023, https://www.oecd.org/en/publications/nordic-lessons-for-an-inclusive-recovery-responses-to-the-impact-of-covid-19-on-the-labour-market_2aa7bcc1-en.html.

Organisation for Economic Co-operation and Development. Nordic Lessons for an Inclusive Recovery? Responses to the Impact of COVID-19 on the Labour Market. OECD Publishing, 2023, https://doi.org/10.1787/2aa7bcc1-en.

—. OECD Employment Outlook 2023: Artificial Intelligence and the Labour Market. OECD Publishing, 2023, https://www.oecd.org/en/publications/oecd-employment-outlook-2023_08785bba-en.html.

Platform, World Bank, Poverty and Inequality. English: Inequality Is the Uneven Distribution of Income, Consumption, Wealth or Opportunities among Different Groups within a Society. 26 Oct. 2024. https://blogs.worldbank.org/en/opendata/inside-the-world-bank-s-new-inequality-indicator--the-number-of-, Wikimedia Commons, https://commons.wikimedia.org/wiki/File:Global_map_of_high_inequality_countries,_2022.png.

Reading A Study of High-Tax Welfare States reminded me of poring over dense policy analysis and economic models during my own academic journey, especially in those semesters when understanding the balance between taxation, social support, and economic outcomes felt so complex that the workload sometimes made me quietly wish someone would finish my online class just to catch a breath; I’m a student of PhD in current days and doing part-time job at The Online Class Help and assisting students in their academic work I have a deep interest in helping others bcz in my college days I suffer alot from these types of hustles I’m really cpnsious about my studies and others, and I remember how working through challenging material with…