Tariffs: A Tax or Economic Warfare

- Taran Konda

- Jan 4

- 6 min read

I’m sure you have seen the word tariff multiple times in the last six months. Something that has become very popular under the Trump administration, tariffs are everywhere and are affecting everyone. But what is a tariff and how does it apply to the United States and the global market? At its core, tariffs are simply a type of tax; however, they can get much more complicated than that.

What is a Tariff?

One of the ways countries throughout the world interact with each other is by importing and exporting goods. Imports consist of a country bringing in foreign goods to use or to sell at home. For example, the United States does not possess the climate to grow mangos but it is a heavily demanded good. To satiate the demands of consumers, the U.S. imports mangos from foreign countries such as Mexico and India. Exports, on the other hand, are goods that are produced in one country but are sold to buyers in a foreign market. When it comes to the U.S., one of the biggest exports is aircraft parts; the United States exported $11.5 billion worth of aircraft components this year.

Why are Tariffs Used?

Exports are a way for countries to make money. Nations are directly selling their products to buyers from the global market. However, with imports, countries are typically losing money as they are the buyers and are spending money on goods. A solution to combat the loss of money when importing goods is tariffs. Tariffs are a tax that the government imposes on imported products. Companies importing goods from foreign countries are responsible for paying this tax to the federal government. This results in companies paying a higher price for goods, and to make up for this increase in spending, they sell these goods at a higher price and customers have to pay more.

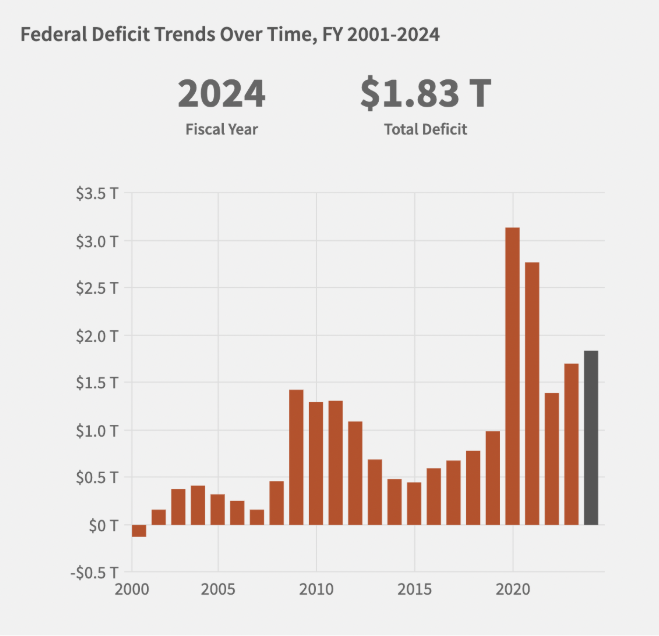

Although tariffs aren’t the most beneficial to consumers as they are paying more for foreign products that are in demand, it is certainly beneficial to the government that imposes them. The federal government in the U.S. makes billions of dollars every year from tariffs and import fees. With President Trump’s new tariff policies, the federal government has already collected $100 billion in gross tariff revenue this year. While this is not normal, the revenue from tariffs was still a significant amount. For example, in 2024, the gross tariff revenue was about $47 billion.

Fig. 1. Government revenue from tariffs throughout the past decade; “How Much Are U.S. Tariffs Raising in Revenue?” Bipartisanpolicy.org, Bipartisan Policy Center, 2025, bipartisanpolicy.org/explainer/tariff-tracker/.

Tariffs don’t only benefit the government. Sometimes tariffs are enacted in the name of protecting domestic industries and goods. Many countries that the U.S. imports from, such as China and Mexico, have lower production costs and thus their products are cheaper. Without tariffs, imported products are much more appealing to customers as they are cheaper than domestically produced ones. However, since tariffs do exist, foreign products can become more expensive than domestic goods and this will encourage consumers to purchase from local companies. Thus, domestic industries are protected from foreign competition and are more in demand. As a result, this can cause more jobs to be created in the country and stimulate the economy.

Who is Hurt by Tariffs?

Tariffs aren’t positive for many people. While the government and domestic industries can benefit from these taxes, most people are hurt by them. When it comes to individual consumers, they are faced with high prices on foreign goods. While buying local products might seem like an easy alternative, there is not always a domestic substitute that is available as the U.S. cannot produce every good that is in demand. Hence, consumers have to pay higher prices if they want certain foreign products. Moreover, some businesses may not want to import products with high tariffs as they are not as profitable. When this occurs, there are less items on the shelves and consumers have a limited access to products.

As stated before, domestic industries can benefit from tariffs. However, there is a caveat to this. Industries that specialize in capital goods, goods that are used by businesses and individuals to produce other goods and services, are more victorious with tariffs. Industries and companies that specialize in consumer goods, goods that are meant for direct consumption, are typically hurt by tariffs. For example, industries that deal with goods such as coffee beans, steel, and aluminum are all “protected” domestic industries under tariffs because they focus on capital goods and raw materials. To produce these goods, imported resources are not needed. Steel and aluminum are derived from natural resources that are mined from the Earth. Coffee beans are crops directly grown from the Earth.

However, industries that focus on consumer goods face more of a challenge. Companies that rely on imported resources to produce their products will have higher input costs. This includes manufacturing industries, such as the automotive industry, and the retail industry. These industries import materials such as cotton, labor, and metals, that are cheaper in the foreign market than they are domestically, to make their goods. With tariffs, however, industries will be met with higher costs and will either have to turn to domestic products or shoulder the financial burden as there are no feasible local substitutes.

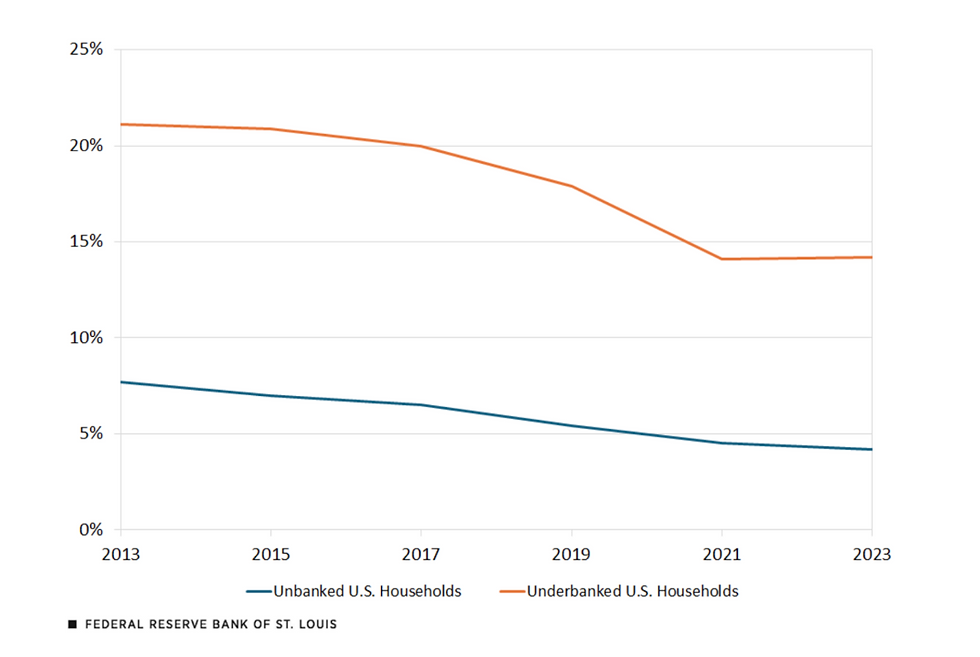

Fig. 2. Companies and fall in stock prices due to new tariffs; Estrada, Sheryl. “The 14 Fortune 500 Stocks Most Exposed to the Tariff War.” Fortune, 16 Apr. 2025, fortune.com/2025/04/16/fortune-500-stocks-most-exposed-tariff-volatility/.

Tariffs as Political Leverage

Although we’ve spoken extensively of how tariffs affect importers, we haven’t discussed how it affects exporters. Exporters greatly depend on trade as they are selling goods and services in the global market for profit. If higher tariffs are placed on certain imports, people will begin to favor domestic goods as they will be cheaper than foreign products. Thus, foreign business will decline and exports will decrease. For exporting countries this means less money. Exporting products is a huge source of revenue for most governments, and if exporting countries lose this source of income, their economy will take a huge hit. Exports are extremely important for almost all nations, and the importance that is put on maintaining global trade relationships has thus become a tool of political leverage. Many countries use tariffs to make other countries and foreign leaders comply with their demands.

The use of tariffs as a political tool has become very common in the past year. In fact, President Trump has very recently used tariffs to threaten Brazil. In the past week, Trump has threatened to impose a 50% tariff on all Brazilian imports coming into the United States, starting August 1st of this year. Why would he do this? It isn’t to protect domestic industries or to create more jobs for Americans, but because of his friendship with Brazil’s former president Jair Bolsonaro. President Bolsonaro, a man that has been called a dictator by many, is on trial currently for trying to overturn election results in 2022 and organizing a coup to remain in power. Although Bolsonaro is disliked by many in his country, President Trump has a strong friendship with him; so much so that he is demanding that the Supreme Court in Brazil drop his case. Calling the entire process a “witch hunt” against Bolsonaro, President Trump is threatening to disrupt the trade relationship between the U.S. and Brazil to protect his own self-interests.

Tariffs as a Whole

Tariffs are taxes that are used to facilitate global trade. In the world we live in today, trade is very common and most people use foreign products in their daily lives. However, tariffs can be complicated. There are different motives behind using tariffs, whether that be to gain government revenue, protect domestic industries, or to influence foreign policy. Additionally, tariffs are not always positive. Most people in the country experience some sort of difficulty or struggle when faced with high tariffs. An economic and political tool, tariffs are, at its simplest, a barrier between nations, businesses, and consumers.

Bibliography

Conover, Damien. “Tariffs Would Likely Hit These US Stock Sectors the Hardest.” Morningstar, Inc., 5 June 2025, www.morningstar.com/stocks/tariffs-would-likely-hit-these-us-stock-sectors-hardest.

Estrada, Sheryl. “The 14 Fortune 500 Stocks Most Exposed to the Tariff War.” Fortune, 16 Apr. 2025, fortune.com/2025/04/16/fortune-500-stocks-most-exposed-tariff-volatility/.

“How Much Are U.S. Tariffs Raising in Revenue?” Bipartisanpolicy.org, Bipartisan Policy Center, 2025, bipartisanpolicy.org/explainer/tariff-tracker/. Accessed 15 July 2025.

Hughes, Eléonore, editor. “Brazil’s Bolsonaro Takes the Stand before the Supreme Court over Alleged Coup Plot.” AP News, 10 June 2025, apnews.com/article/brazil-bolsonaro-trial-coup-578007b7e4444827be57d2bda2fff663. Accessed 15 July 2025.

IBISWorld. “The Impact of US Tariffs: Which Industries Are Most and Least Affected.” Ibisworld.com, 31 Oct. 2024, www.ibisworld.com/blog/us-tariffs/1/1127/.

Inskeep, Steve. “Trump’s Brazil Tariffs Are ‘Grotesquely Illegal,’ Says Nobel Prize-Winning Economist.” NPR, 14 July 2025, www.npr.org/2025/07/14/nx-s1-5464923/nobel-prize-winning-economist-paul-krugman-discusses-trumps-use-of-tariffs. Accessed 15 July 2025.

OEC. “United States (USA) Exports, Imports, and Trade Partners.” Oec.world, 2023, oec.world/en/profile/country/usa.

Russell, Alex. “How Could Tariffs Affect Consumers, Business and the Economy?” UC Davis, 18 Feb. 2025, www.ucdavis.edu/magazine/how-could-tariffs-affect-consumers-business-and-economy.

“Tariffs: Weighing the Pros and Cons of Trade Barriers.” Raymondjames.com, Southern Springs Capital Group, 2025, www.raymondjames.com/southernspringscapitalgroup/resources/southern-springs-blogs/2025/03/20/tariffs-weighing-the-pros-and-cons-of-trade-barriers.

Main Image for Article:

Mitchell, Molly. “Q&A: How Could Tariffs Impact Your Wallet? – Darden Report Online.” Darden Report Online, 10 Mar. 2025, news.darden.virginia.edu/2025/03/10/qa-how-could-tariffs-impact-your-wallet/.

Comments