How Milei Changed the Argentinian Economy

- Young Kim

- Aug 14, 2025

- 3 min read

By many measures, the title of “boldest economic reforms carried out in the 21st century” belongs to the reforms carried out by Javier Milei following his victory in the 2023 November elections. Vowing to upturn the precedence set by his Peronist predecessors, who were largely in favor of the nationalizing the economy in many respects, Milei has pursued a policy entirely different. He was in favor of radical turnaround to a surge in agricultural exports, lower import demand, and a restored current-account surplus. Milei Milei systematically liberalized the peso, using a stronger currency to bring runaway inflation under control, while shedding currency controls, securing IMF support, and pivoting Argentina back toward fiscal discipline.

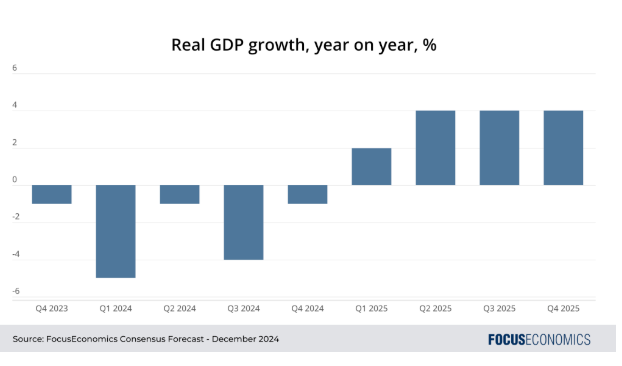

Argentina entered 2024 with triple-digit inflation, empty reserves, and an IMF program badly off-track. Milei’s first move was an overnight 54 % devaluation of the peso and a promise to run the first primary surplus since 2009. Three months later, the IMF confirmed that the plan—built on a fixed fiscal anchor, a crawling-peg exchange rate, and sweeping deregulation—had produced the budget surplus and halted reserve losses. Monthly inflation, which had peaked at 29 % in December 2023, slid into single digits by mid-2024 and reached just 1.5 % in May 2025, the lowest since 2020. This rapid disinflation let the central bank slow the crawl of the exchange rate to only 1 % per month without triggering a new run on the peso. International reserves, which had been negative on a net basis, turned positive again in April 2025, supported by a $5 billion currency swap with China.To fund the surplus, the administration cut discretionary transfers to provinces, reduced energy and transport subsidies, and froze public-sector wages—measures that slashed primary spending by 30 % in real terms. The medicine was harsh: GDP contracted 2.6 % quarter-on-quarter in Q1-2024, pushing the economy into recession. Private surveys recorded a spike in poverty to 42 % at the height of the austerity shock. By late-2024, signs of recovery emerged. FocusEconomics reported GDP growth of 3.9 % in Q3-2024 and 7.6 % annualised in Q2-2025, the fastest in two decades, where many credited the turnaround to a surge in agricultural exports, lower import demand, and a restored current-account surplus.The peso’s stabilization helped reopen carry-trade inflows, allowing the central bank to ease some capital controls from 2019. This renewed investor interest in Argentine assets and strengthened short-term financial inflows. However, austerity hit labor markets: public-sector wages dropped sharply in real terms, construction jobs were frozen amid halted public works, and informal employment surged—formal workers earning far more than informal ones. The contrast between sectors widened. Still, unemployment has declined from its early spike, and official statistics show poverty fell noticeably in late 2024, helped by cooling inflation, wage gains in the private sector, and a modest recovery in formal job creation.

Under his mega-decree (Decreto 70/23), Milei eliminated price controls, opened domestic airline routes to foreign competition, and scrapped nearly 300 regulations spanning labor, trade, and industry. These sweeping changes led to a steep rise in measured “government efficiency,” with Argentina making one of its largest-ever jumps in global competitiveness rankings. Yet legal challenges and court injunctions have clouded the reforms. Congress has even moved to increase pensions, a measure Milei is poised to veto, setting up a political standoff over fiscal priorities and the direction of long-term policy.

Eighteen months in, macro indicators—budget balance, reserves, inflation—have all rebounded, and most Argentines appear cautiously optimistic, at least regarding short-term stabilization. But the gains remain uneven: informal workers earn much less than their formal peers, wage inequality persists, and household consumption hasn’t returned to pre-crisis levels. The durability and inclusivity of Milei’s reforms now depend on long-term institutional commitments—and the politics is far from settled.

Works Cited

“Argentina’s April Economic Activity Beats Forecasts to Bolster Milei Rebound.” Reuters, 30 June 2025, https://www.reuters.com/world/americas/argentina-economic-activity-grows-77-april-above-expectations-2025-06-30/. Accessed 17 July 2025.

“Argentina Economy Stalls Again in June in Challenge for Milei.” Reuters, 21 Aug. 2024. www.reuters.com, https://www.reuters.com/world/americas/argentina-economy-stalls-again-june-challenge-milei-2024-08-21/.

Argentina, Presidencia de la Nación. Decreto de Necesidad y Urgencia 70/2023: “Bases para la Reconstrucción de la Economía Argentina.” Boletín Oficial de la República Argentina, 20 Dec. 2023, Argentina.gob.ar/normativa/nacional/decreto‑70‑2023‑395521. Accessed 17 July 2025.

Argentina Raises $1bn in International Bond Auction in Boost for Javier Milei. Financial Times, 29 May 2025, https://www.ft.com/content/c8ef9831-ac71-4bd0-9ac2-6339438ccdb7. Accessed 17 July 2025.

bigseocontact. “Understanding the Transformation of Argentina’s Economy Under Milei.” FocusEconomics, 2 Dec. 2024, https://www.focus-economics.com/blog/argentina-economy-under-milei/. Accessed 17 July 2025.

“Deal Extension Allows Trump Ally Argentina to Borrow Another $5 Billion from China.” Associated Press, 10 April 2025, https://apnews.com/article/china-argentina-trump-trade-credit-2a1c3b4f2eb304d21c8db9d903a08792. Accessed 17 July 2025.

“In Argentina, Reserves Build‑Up Stalls as Dollars Exit.” Reuters, 6 June 2025, https://www.reuters.com/world/americas/argentina-reserves-build-up-stalls-dollars-exit-2025-06-06/. Accessed 17 July 2025.

Stott, Michael. “Javier Milei’s Risky Bet on a Potent Peso.” Financial Times, 14 July 2025, https://www.ft.com/content/494ca350-d3d4-488e-a657-fa7c13d8abd5. Accessed 17 July 2025.

Comments