The Intricate Spending of the Federal Government: National Debt and Budget Deficits

- Max Raffel

- Dec 19, 2025

- 5 min read

Have you ever seen the words budget deficit or national debt being brought up when new spending bills are being passed or when someone talks about government spending? I’m sure you have, and similar to how people can go into debt by spending too much, the government can accumulate debt as well.

Budget Deficits

The government, although they do not sell goods or services, makes money. Their sole source of income is through taxation. Income taxes, sales taxes, and property taxes are some examples of taxation that people are responsible for. Using their income for different purposes, such as national defense, social security, education, and healthcare, sometimes the government spends more money than it makes. When this happens a budget deficit occurs. So, a budget deficit is when the government’s expenditures exceed its revenue over a specific period of time, usually one fiscal year.

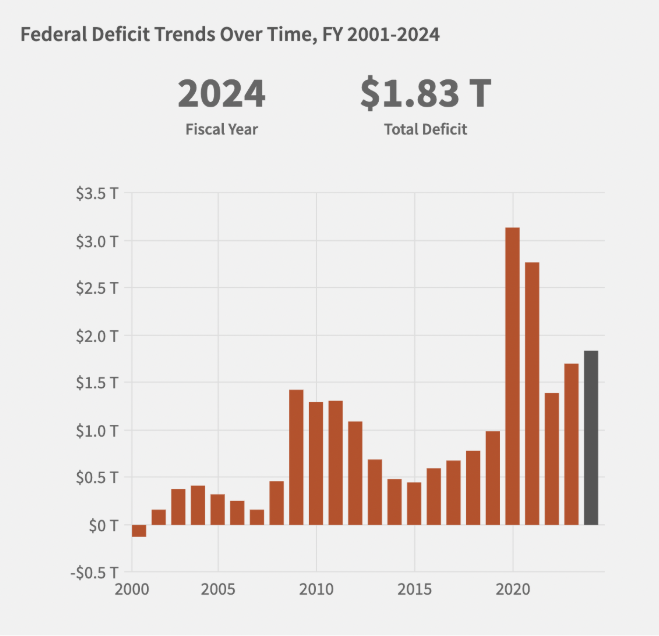

Fig. 1. U.S. federal deficit every year since 2001; Fiscal Data. “Fiscal Data Explains the National Deficit.” Fiscaldata.treasury.gov, 2025, fiscaldata.treasury.gov/americas-finance-guide/national-deficit/.

National Debt

National debt is the accumulation of all budget deficits that have occurred over time. Generally, the government goes into a deficit every year. The last time a budget surplus, in which government spending is less than government revenue, occurred was in 2001. In the past 5 years, there has been a budget deficit of more than $1 trillion every single year. Currently, the national debt is around $36.63 trillion and it is projected to only grow from here. With the passing of President Donald Trump’s “big, beautiful bill”, it is predicted that $3 trillion to $4 trillion will be added to the national debt over the next 10 years.

Fig. 2. Federal debt of the U.S. from 1940 to 2023, and expected federal debt from 2023 to 2053; Dynan, Karen. “Addressing Rising US Debt | Econofact.” Econofact.org, 15 Nov. 2023, econofact.org/addressing-rising-us-debt.

Why are Budget Deficits and National Debt a Problem?

Like individuals, it is not good for the government to be in debt. When a person is in debt, it slows down their economic growth and hinders their financial abilities. The same can be said for the federal government. When the federal government is in a budget deficit, and is adding to the national debt, they are actively borrowing money to cover their expenses as they do not have enough revenue to fund their costs. Therefore, the government’s demand for loans increases. As a general rule in economics, when the demand for loans increases in the loanable fund market, the interest rate in the country increases as well. So, when the government starts borrowing money, people are affected by this action through higher interest rates. Higher interest rates cause individuals and businesses to be apprehensive of borrowing, investing, and spending their money. For example, interest rates are applicable to credit cards. When the interest rate on your credit card gets higher, you will likely want to spend less money as your credit card bills will be higher because of the increase in interest. Moreover, if you have a savings account with variable interest, it would be smarter to keep your money in that savings account as it would accrue higher interest and your money would grow faster. The same thing applies to businesses. As a result, many people aren’t spending and this slows down economic growth. This entire phenomenon is called the crowding out effect.

Fig. 3. An increased demand for loanable funds by the government and how that affects interest rates; “AP Macro: Crowding Out.” Tamoclass, 7 Mar. 2014, tamoclass.wordpress.com/2014/03/07/ap-macro-crowding-out/.

However, budget deficits are considered a necessary evil by many economists. Why is that? It is because increased government spending can stimulate the economy. When a country is experiencing a recession this means there is a lower amount of consumer spending and output is low. To increase consumer spending and resolve a recessionary gap, the government can increase its spending. This can increase GDP, or gross domestic product, and increase economic growth. However, there is still the crowding out effect to consider. The crowding out effect can reduce the positive effects of increased government borrowing, and there are some economists that believe the crowding out effect completely cancels out the benefits of increased government spending.

Fixing the Issue

The United States and its national debt is astronomical. A figure that keeps rising with every passing year, the idea of eliminating the U.S. national debt is becoming more and more popular. But, how does the government even begin to tackle this debt? The most common and feasible way is enacting spending cuts while simultaneously raising taxes. At its core, national debt is the result of government spending that goes about the government’s revenue. By raising taxes, the government will have a larger income. Moreover, if the government enacts spending cuts and consumes less money, while making a larger revenue through higher taxes, there will be a larger national surplus.

Although it sounds simple in theory, raising taxes and establishing spending cuts is not an easy thing to do. As the U.S. national debt is enormous, spending cuts and tax increases that amount to trillions of dollars would have to occur to make a significant dent in the debt. This is a difficult thing to accomplish because large spending cuts or tax increases are usually met with opposition and can sometimes slow down economic growth. For example, raising taxes to such a degree will directly affect Americans and cause people to have a more limited economic mobility. When taxes increase, a larger portion of a person’s income goes to state and federal funding and a smaller portion is left to spend. As people cannot consume as many goods and services, there is a decrease in consumer demand and spending, which causes a decline in GDP. Similar to individuals, businesses are also affected by tax increases because they are less motivated to invest. Higher taxes can make investments seem less profitable, and as a result, businesses will spend less money and the GDP will decline.

As getting out of the national debt is as messy as getting into it, many question whether or not it is beneficial and feasible to completely eliminate it. As stated before, some see budget deficits and the national debt as a necessary evil because it is a tool to stimulate the economy during a recession. Moreover, trying to get rid of the entirety of the United States’ national debt will cause an economic decline in the country and a great amount of dissatisfaction among Americans.

The entire issue of national debt is a complex and messy one. While generally thought to be negative and cause economic decline, budget deficits and national debt can help stimulate economic growth in certain instances. Furthermore, trying to completely eradicate the national debt is a problem in itself. Government spending and budgets are a multifaceted economic phenomenon.

Bibliography

“AP Macro: Crowding Out.” Tamoclass, 7 Mar. 2014, tamoclass.wordpress.com/2014/03/07/ap-macro-crowding-out/.

Cornforth, Ed. “Which Taxes Are Best and Worst for Growth?” Economics Observatory, 20 May 2024, www.economicsobservatory.com/which-taxes-are-best-and-worst-for-growth.

Dynan, Karen. “Addressing Rising US Debt | Econofact.” Econofact.org, 15 Nov. 2023, econofact.org/addressing-rising-us-debt.

Fiscal Data. “Fiscal Data Explains the National Deficit.” Fiscaldata.treasury.gov, 2025, fiscaldata.treasury.gov/americas-finance-guide/national-deficit/.

Hormats, Robert. “The GOP Budget Will Balloon the National Debt. Here’s What Trump Could Do to Fix It.” TIME, Time, 3 July 2025, time.com/7300014/budget-national-debt-trump-fix-it/. Accessed 10 July 2025.

Kenton, Will. “The Government’s Roll in the Crowding out Effect.” Investopedia, 26 May 2024, www.investopedia.com/terms/c/crowdingouteffect.asp.

Smith, Lisa. “How Governments Reduce the National Debt.” Investopedia, 24 June 2021, www.investopedia.com/articles/economics/11/successful-ways-government-reduces-debt.asp.

US Treasury. “What Is the National Debt?” Fiscaldata.treasury.gov, 2025, fiscaldata.treasury.gov/americas-finance-guide/national-debt/.

Main Image for Article:

Abse, Nathan. “The Debt Ceiling Could Hurt Feds’ Paychecks—but Only If Things Drag on - Government Executive.” Government Executive , 2023, www.govexec.com/pay-benefits/2023/01/debt-ceiling-could-hurt-feds-paychecks-only-if-things-drag/382137/. Accessed 25 July 2025.

This article offers a thorough look at how federal government spending, national debt, and budget deficits are interconnected, and it does a good job of breaking down complex fiscal concepts in a way that makes them more understandable for readers. For students and lifelong learners trying to grasp topics like macroeconomics, public finance, or policy analysis, having access to an online course help service can provide valuable support in clarifying difficult material, reinforcing key ideas, and staying on track with coursework so they can build confidence and deeper understanding as they study these important issues.